Lloyd Cazes specializes in structuring tax deferred transactions on sale of real estate, stocks and other capital assets.

When an owner (business or individual) prepares to sell a capital asset, the owner should consider the opportunity to defer the taxes with a collateralized installment sale. The gain on the sale in this type of transaction can be tax deferred for 30 years. Lloyd Cazes can structure the transaction as a “Monetized Installment Sale”. Proceeds are paid to the seller at the closing as in any sale, but taxes on the gain are not due for up to 30 years.

We have a proven track record of helping individuals and small business accumulate wealth and preserve their hard earned assets.We can implement unique strategies that optimize business productivity and increase efficiency in your operations. This always results in increased revenue and preservation of profits.

Structuring tax deferred transactions on sale of capital assets

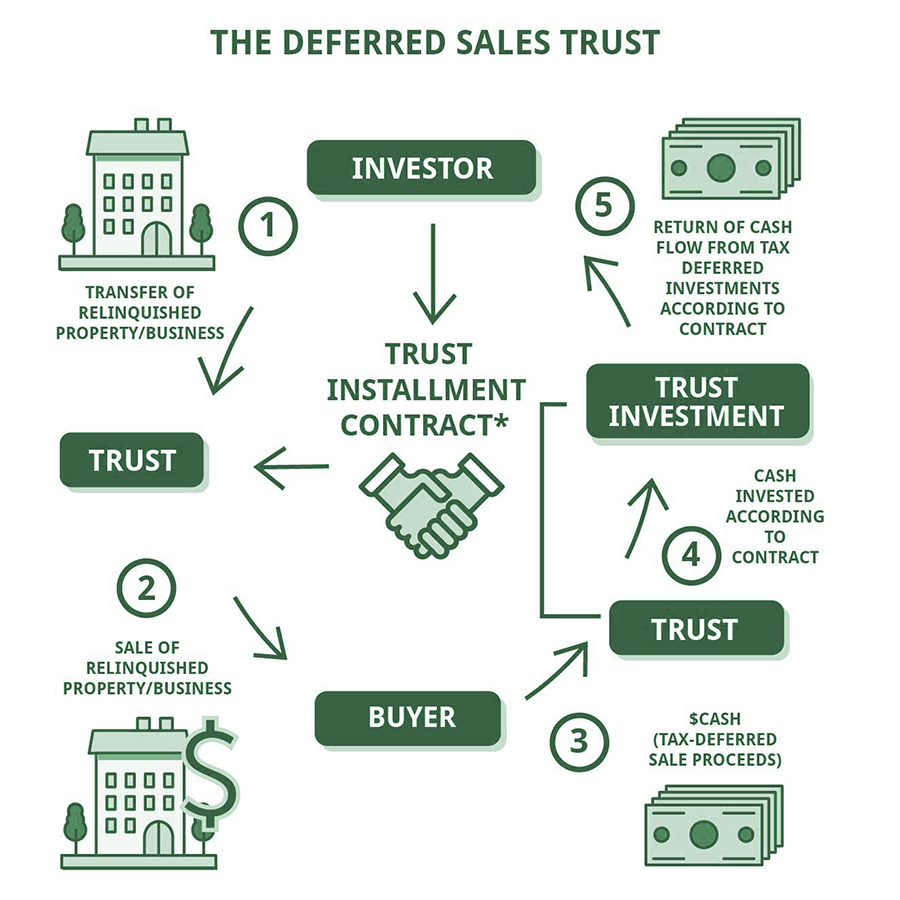

HOW IT WORKS...

Years ago, Congress recognized that it may not be appropriate to tax the entire gain realized by a seller in the taxable year of the sale when the seller has not received the entire purchase price for the property sold; for example, where the seller is to receive a payment from the buyer in a taxable year subsequent to the year of the sale, whether under the terms of the purchase and sale agreement or pursuant to a promissory note given by the buyer to the seller in full or partial payment of the purchase price.

In cases where the payment of the purchase price is thus delayed, the seller has not completed the conversion of their property to cash; rather than having the economic certainty of cash in their pocket, the seller has, instead, assumed the economic risk that the remaining balance of the sale price may not be received. It is this economic principle that underlies the installment method of reporting.

A sale of property where at least one payment is to be received after the close of the taxable year in which the sale occurs is known as an “installment sale. ”For tax purposes, the gain from such a sale is reported by the seller using the installment method.

Under the installment method, the amount of any payment which is treated as income to the seller for a taxable year is that portion (or fraction) of the installment payment received in that year which the gross profit realized bears to the total contract price (the “gross profit ratio”). Generally speaking, the term “gross profit” means the selling price for the property less the taxpayer’s adjusted basis for the property – basically, the gain.

Stated differently, each payment received by a seller is treated in part as a return of their adjusted basis for the property sold, and in part (the gross profit ratio) as gain from the sale of the property. Learn more...

Lloyd Cazes C.P.A. specializes in structuring tax deferred transactions on sale of capital assets, e.g. real state, stock, minerals and other valuable assets.

When an owner (business or individual) prepares to sell a capital asset, the owner should consider the opportunity to defer the taxes with a collateralized installment sale. The gain on the sale in this type of transaction can be tax deferred for 30 years.

Lloyd Cazes and S. Crow Capital Assets can structure the transaction as a “Monetized Installment Sale”. Proceeds are paid to the seller at the closing as in any sale, but taxes on the gain are not due for up to 30 years.

When an owner sells an asset as a “Monetized Installment Sale” the owner enters into at transaction defer the gain on the sale under IRS code sec. 453. There is immediate access to the proceeds through the third party facilitator.

There is documentation for approval of this type of transaction by the IRS as recent as August 2012.

This type of transaction achieves these results:

1. An all-capital-gain installment sale of the asset, with the capital-gains tax deferred for as long as 30 years, with no net tax cost to the seller for that entire period;

2. Immediately available non-taxable monetization loan proceeds for the seller nearly equal to the selling price, with the entire repayment of the monetization loan funded by the third party lender installment payments to the seller, at no net cost to the seller for interest or principal payments;

3. Complete freedom for the seller to invest the monetization loan proceeds as the seller chooses, without any involvement by the third party or the lender in that investment, and without any payment whatever from that investment to third party lender.

Example:

Mary and Joe want to sell their appreciated asset ( no cost basis ) but find that taxes due will take 36% of the proceeds.

On a gain of $ 1,000,000 the tax is $ 360,000.

This gain can be deferred for 30 years.

During this period the gain increases at 5% after tax per year. It is now worth $ 4,000,000 and available to pay the $ 360,000 taxes.

This can be used in conjunction with 1031 exchanges, sale of professional practice, buyer prepayments and other capital sale transactions